Gain valuable market insights and connect with our local agents today to make informed real estate decisions in Austin. Our blogs offer transparent outlooks and data for current and prospective homeowners and renters, whether you're buying or selling.

Mortgage Rates Boost Holiday Homebuying

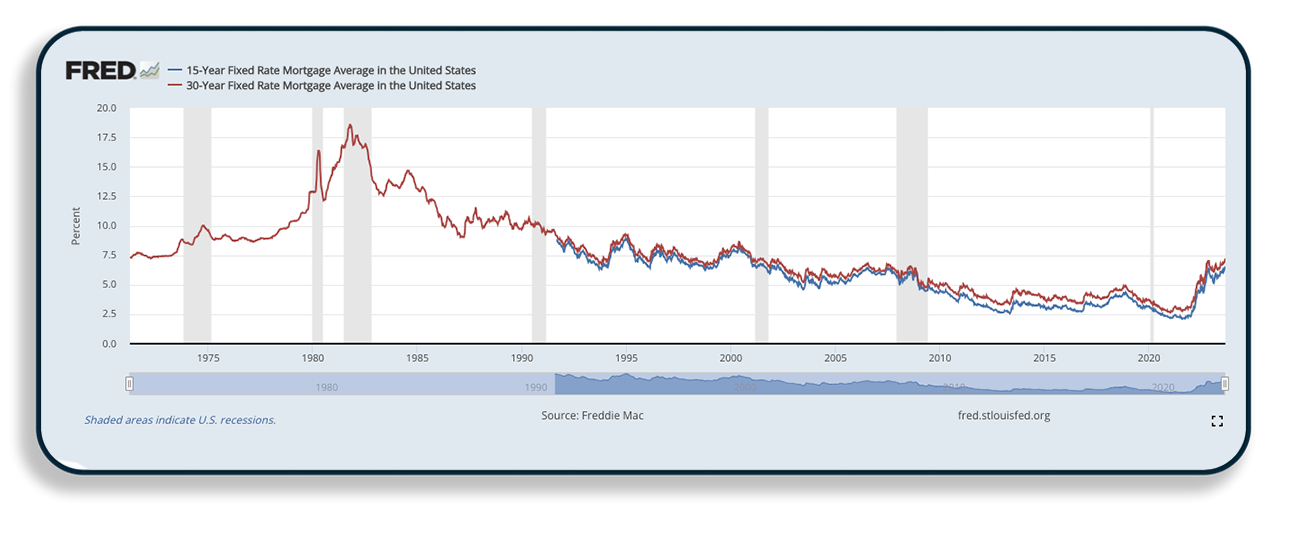

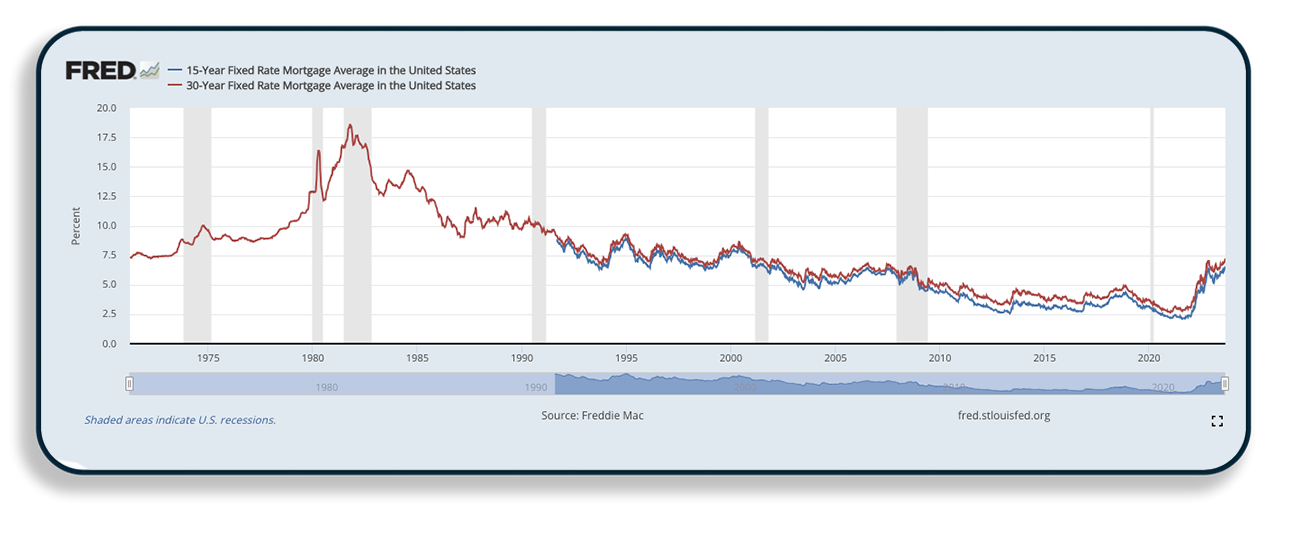

Mortgage rates falling below 7%, ignite holiday homebuying. The Freddie Mac Primary Mortgage Market Survey, which focuses on conventional and conforming loans with a 20% down payment, shows the 30-year fixed rate averaged 6.61% as of December 28th, down from last week’s 6.67%. The 30-year was at 6.42% a year ago at this time.

The sustained drop is attributed to the Federal Reserve's indication of potential rate cuts in 2024. Freddie Mac's survey reveals increased activity in both home purchases and refinancing. The Mortgage Bankers Association found that demand for buying homes went up in five of the past six weeks, and refinancing went up by 19% last week, which is 27% more than last year.

This signals an opportune moment for buyers and refinancers to benefit from favorable market conditions. Freddie Mac believes that given “the Federal Reserve Board’s current expectations that they will lower the federal fund's target rate next year, we likely will see a gradual thawing of the housing market in the new year.”

e Average and 10-Year Treasury Yield (1972-2023)

The current spread of 2.786 as of December 26th is larger than the 50-year 1.7 average spread because mortgage companies are charging more as they know the mortgages are going to get refinanced once the rates come back down.

Will Mortgage Rates Come Back Down?

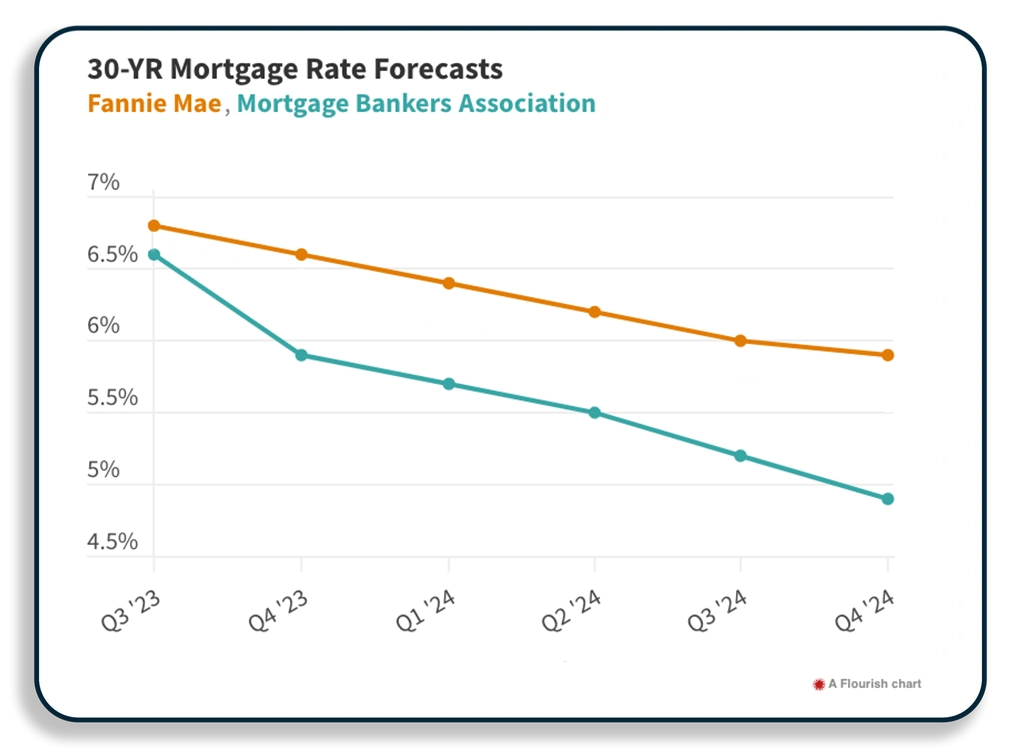

Rates will come down. It’s just a matter of time, according to economists at Fannie Mae and the Mortgage Bankers Association. When rates do come down, it will improve affordability for prospective home buyers.

Fannie Mae and MBA Mortgage Rate Forecasts

Source: Fannie Mae, MBA, US News

Fannie Mae predicts a slow but meaningful recovery in home sales and mortgage originations in 2024, attributing it to a recent decline in mortgage rates. Purchase mortgage applications have rebounded by about 15% since November. However, persistent challenges like affordability issues may slow down the recovery. Fannie Mae acknowledges a potential mild economic downturn in 2024 but emphasizes cautious optimism in the housing market.

Pro Tip: Learn more about how buyers and sellers can win with 2-1 Buydowns. It may be possible to negotiate a rate “buydown” paid by the seller. This seller concession can reduce the amount you need to pay each month. Many sellers prefer this to reducing the sale price of their home. When rates fall in the future you may be able to refinance to a lower rate.

Engage with a local real estate expert for valuable insights into your home search or sale objectives. Uncover distinct advantages in our current market for special opportunities. Remember, mortgage rates can change rapidly, so stay informed by consulting with your mortgage professional. Connect with us today for informed decisions in your real estate journey.